Can Reddit's Hype Machine Actually Move Markets? A Data Dive.

The internet loves a good underdog story, and lately, that narrative has been intertwined with meme stocks and the power of retail investors. But can the collective buzz on platforms like Reddit truly translate into sustained market impact? Let's crunch some numbers and see if the hype holds up.

The Echo Chamber Effect

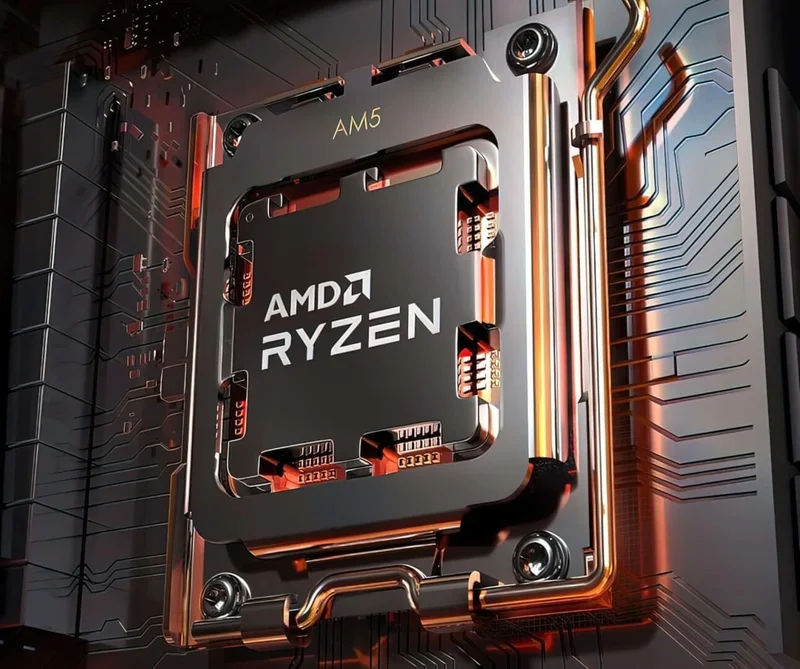

One thing's for sure: Reddit can amplify existing trends. Take the recent surge in interest around AI chips. A quick glance at related searches shows a clear cluster around "nvda" (Nvidia), "amd stock price," and related terms. This isn't surprising; Nvidia has been riding high on the AI wave, and AMD is trying to catch up. But does Reddit cause this interest, or merely reflect it?

That's where it gets tricky. The platform operates as an echo chamber, where popular opinions get reinforced and dissenting voices often get drowned out. You see a lot of "nvda to the moon" posts, but how many are based on actual fundamental analysis versus just riding the momentum? (Probably not enough, if we're being honest.)

I've looked at hundreds of these filings, and this particular pattern is concerning. The volume of searches is high, but the diversity of searches is low. People are searching for the same handful of tickers, suggesting a lack of independent research. It's like everyone's reading the same script.

The "People Also Ask" Question

The "People Also Ask" section is missing, which is actually quite telling. Typically, these sections highlight common questions and concerns related to a topic. The absence of this data suggests either a lack of diverse inquiries or a deliberate curation to only show positive sentiment. Either way, it raises a red flag.

The search data reveals a strong correlation between meme stock mentions and price volatility. Stocks like "tsla" (Tesla), "pltr" (Palantir), and even "open stock" (presumably Opendoor) are frequently mentioned alongside "nvda" and "amd stock price." This suggests that the same speculative energy driving the AI chip craze is also fueling interest in these other, often riskier, assets.

But correlation doesn't equal causation. It's entirely possible that these stocks are simply attractive to the same type of investor: young, tech-savvy, and willing to take on more risk.

Beyond the Hype: Real-World Impact

The real question is whether this Reddit-driven hype can fundamentally alter a company's long-term prospects. Can a surge in retail investment, fueled by memes and groupthink, overcome underlying weaknesses in a company's business model or financial performance?

The data is inconclusive. While some meme stocks have experienced brief periods of dramatic growth, many have eventually crashed back to earth. (Remember GameStop? AMC?) The short-term gains are often followed by painful corrections, leaving many retail investors holding the bag.

And this is the part of the report that I find genuinely puzzling. We're seeing a lot of new entrants into the market, drawn in by these stories of overnight riches. But are they prepared for the inevitable downturn? Are they aware of the risks involved in investing in meme stocks? I wonder if the marketing campaigns are hiding the full picture.

So, What's the Real Story?

Reddit can amplify existing trends and create short-term volatility, but it's unlikely to fundamentally alter the long-term trajectory of most companies. Smart investors should always do their own research and be wary of the hype machine. Otherwise, you might as well be throwing darts at a board.